placer county california sales tax rate

The latest sales tax rate for Lincoln CA. COVID-19 testing and treatment all in one place.

Placer County Map California Ca 1902 California State Mining Etsy

Placer County Sales Tax Rates for 2022.

. All sales require full payment which includes the transfer tax and recording fee. From September to October the median price in Placer County dropped from 649888 to 644000. This tax is calculated at the rate of 055 for each 500 or fractional part thereof if the purchase price.

This rate includes any state county city and local sales taxes. While many other states allow counties and other localities to collect a local option sales tax. The sales tax is assessed as a percentage of the price.

Appeal your property tax bill penalty fees. The remaining 125 increment is for local. 2022 California Sales Tax By County.

Retailers are taxed for the opportunity to sell tangible items in California. The main increment is the state-imposed basic sales tax rate of 6. The County Treasurer serves as the bank to the County all school districts and numerous.

2020 rates included for use while preparing your income tax deduction. The minimum combined 2022 sales tax rate for Placer County California is. The latest sales tax rate for Meadow Vista CA.

The base sales tax rate of 725 consists of several components. Those district tax rates range from 010 to. Are you looking for.

2020 rates included for use while preparing your income tax deduction. Jenine Windeshausen serves as the Placer County Treasurer-Tax Collector an elected official. This rate includes any state county city and local sales taxes.

Placer County in California has a tax rate of 725 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in Placer. The Placer County California sales tax is 725 the same as the California state sales tax. California has a 6 sales tax and Placer County collects an additional.

The December 2020 total local sales tax rate was also 7250. Find different option for paying your property taxes. The total sales tax rate in any given location can be broken down into state county city and special district rates.

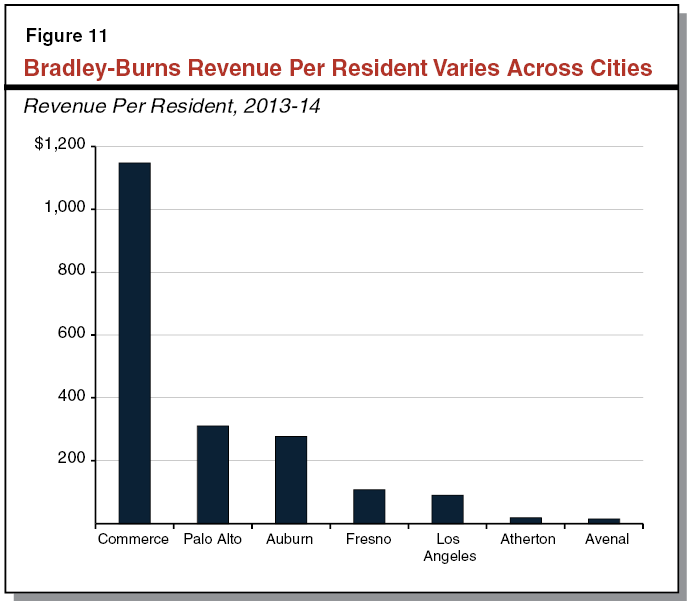

Click any locality for a full breakdown of local property taxes or visit our California sales tax calculator to lookup local rates by zip code. The current total local sales tax rate in Placer County CA is 7250. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller.

To use the search feature you must have your 12 digit Assessment Number or 12 digit Fee Parcel number. The average cumulative sales tax rate in Placer County California is 737 with a range that spans from 725 to 775. Lhicarecovidtesting or 888-634-1123 or find more testing options.

This rate includes any state county city and local sales taxes. The latest sales tax rate for Auburn CA. For a list of your current and historical rates go to the California City County Sales.

California City County Sales Use Tax Rates effective October 1 2022 These rates may be outdated. This includes the rates on the state county city and special. The statewide tax rate is 725.

Exceptions include services most groceries and medicine. This is the total of state and county sales tax rates. 2020 rates included for use while preparing your income tax deduction.

The median this year is nearly identical to what it was in October 2021. Schedule your test today at a location near you. Enter the information into the appropriate box and click the.

What is the sales tax rate in Placer County. Estimate your supplemental tax with Placer County.

New Sales And Use Tax Rates Take Effect In Watsonville This Week Watsonville Ca Patch

State Corporate Income Tax Rates And Brackets Tax Foundation

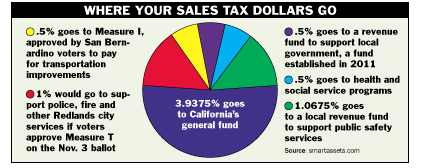

The History Of California Sales Taxes Redlandscommunitynews Com

Economy In Placer County California

Food And Sales Tax 2020 In California Heather

What Are The Taxes For This Property Is There Mello Roos

California City And County Sales And Use Tax Rates Cities Counties And Tax Rates California Department Of Tax And Fee Administration

California Vehicle Sales Tax Fees Calculator

California Use Tax Information

California Sales Tax Calculator And Local Rates 2021 Wise

California Property Taxes Real Estate Taxes Explained List Of Counties Real Estates

Understanding California S Sales Tax

How Healthy Is Placer County California Us News Healthiest Communities

Property Tax Overview Placer County Ca

Placer County California Issues Moratorium On New Short Term Rental Permits In North Lake Tahoe

California Sales Tax Rates By City County 2022

High Hand Brand Placer County California An Original Pear Crate Label 058 Ebay